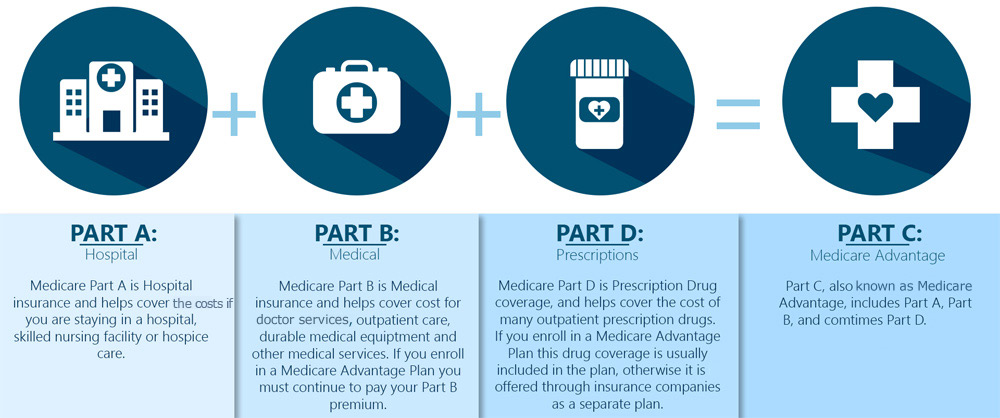

Let us help you simplify your Medicare coverage. A Medicare Advantage plan combines hospital, doctor, and prescription drug coverage. These compact plans may also include other benefits not offered through original Medicare.

Let us help you simplify your Medicare coverage. A Medicare Advantage plan combines hospital, doctor, and prescription drug coverage. These compact plans may also include other benefits not offered through original Medicare.

Need more predictable out-of-pocket costs? We can enroll you in a Medicare supplement plan that can help fill the gaps in your Medicare Part A and B coverage, so there are fewer surprise expenses.

We can help you better manage your prescription expenses with a Medicare Part D prescription drug plan. Contact me to decode the eligibility requirements.

Part A Premium (Effective January 1, 2022):

- Most people don’t pay a monthly premium for Part A

- If you paid Medicare taxes for less than 30 quarters, the Part A premium is $499.

- If you paid Medicare taxes for 30-39 quarters, the Part A premium is $274.

Part A hospital inpatient and coinsurance (Effective January 1, 2021). You pay:

- $1,556 deductible for each benefit period.

- Days 1-60: $0 coinsurance for each benefit period.

- Days 61-90: $389 coinsurance per day of each benefit period.

- Days 91 and beyond: $704 coinsurance per each “Lifetime Reserve Day” after day 90 for each benefit period (up to 60 days over your lifetime).

- Beyond Lifetime Reserve Days: All costs

Part B Premium (Effective January 1, 2022)

- The standard Part B premium amount for 2021 is $170.10 (or higher depending on your income).

Part B deductible and coinsurance (Effective January 1, 2021). You pay:

- $233 deductible per year.

- After your deductible is met, you typically pay 20% of the Medicare approved amount for most doctor services (including while you are a hospital inpatient), outpatient therapy and durable medical equipment.

Part C (Medicare Advantage plans) Premium:

- The Part C premium varies by plan.

Part D (Prescription Drug Plans) Premium:

- The Part D monthly premium varies by plan.

- Higher income consumers may pay more.